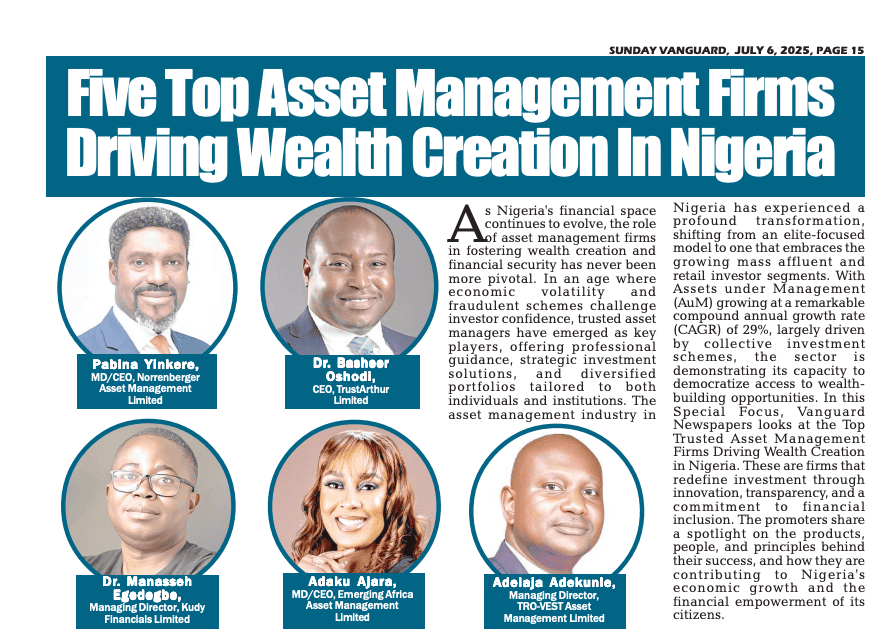

As Nigeria’s financial space continues to evolve, the role of asset management firms in fostering wealth creation and financial security has never been more pivotal.

In an age where economic volatility and fraudulent schemes challenge investor confidence, trusted asset managers have emerged as key players, offering professional guidance, strategic investment solutions, and diversified portfolios tailored to both individuals and institutions.

The asset management industry in Nigeria has experienced a profound transformation, shifting from an elite-focused model to one that embraces the growing mass affluent and retail investor segments. With Assets under Management (AuM) growing at a remarkable compound annual growth rate (CAGR) of 29%, largely driven by collective investment schemes, the sector is demonstrating its capacity to democratize access to wealth-building opportunities.

In this Special Focus, Vanguard Newspapers looks at the Top Trusted Asset Management Firms Driving Wealth Creation in Nigeria. These are firms that redefine investment through innovation, transparency, and a commitment to financial inclusion. The promoters share a spotlight on the products, people, and principles behind their success, and how they are contributing to Nigeria’s economic growth and the financial empowerment of its citizens.

Adelaja Adekunle, Managing Director, TRO-VEST Asset Management Limited

Building Futures, Not Just Portfolios: Adelaja Adekunle on Restoring Trust and Redefining Wealth Management at TRO-VEST Asset Management

Adelaja Adekunle is a seasoned fund manager, financial strategist, and influential voice in Nigeria’s investment space, with over two decades of experience spanning traditional banking, asset management, and fintech innovation. As the Managing Partner at Tro-vest Group and Managing Director of TRO-VEST Asset Management Limited, he leads a forward-thinking consortium committed to bridging conventional finance with digital wealth-building solutions.

Throughout his career, Adelaja has held pivotal leadership positions, including Group Head, Risk Management & Compliance at VFD Group Plc, Chief Compliance Officer at Coronation Asset Management, COO at Xerde Limited, and Financial Controller at ALICO Capital. His career reflects a rare ability to navigate both conservative financial structures and agile, tech-driven environments.

A Fellow of the Chartered Institute of Bankers of Nigeria and an Associate Chartered Accountant, Adelaja is SEC-recognized and an active member of the Fund Managers Association of Nigeria. He was honored as Asset Manager of the Year (2021) by African Leadership Review Magazine, a testament to his credibility and excellence in wealth management.

Speaking about the company’s origins, Adekunle explained that TRO-VEST Asset Management Limited was founded out of a deep concern for the growing mistrust in Nigeria’s investment space, which has been plagued by misinformation, Ponzi schemes, and a lack of transparency. He noted that the company identified a critical gap not only in service delivery but also in empathy and investor trust.

According to him, TRO-VEST’s mission is to create a reliable and transparent platform where individuals, cooperatives, and corporate entities can grow their wealth through ethical, data-driven, and professionally managed investment solutions.

“We believe that every Nigerian deserves access to structured financial growth,” Adekunle emphasized. “TRO-VEST was established to serve as that bridge connecting people to real, long-term opportunities for wealth creation.”

Adekunle highlighted the foundational values that shape TRO-VEST Asset Management Limited’s approach to wealth management, noting that the firm’s philosophy is deeply rooted in trust, strategic insight, and reliability. He explained that TRO-VEST’s core values, Trust, Objectivity, Reliability, and Innovation are not merely aspirational statements but guiding principles that empower clients to achieve their financial goals. Trust, he said, means prioritizing the client’s best interest and fostering relationships built on transparency and ethical conduct. Objectivity is achieved through data-driven insights that ensure investment strategies remain unbiased and aligned with each client’s unique aspirations. Reliability speaks to the company’s consistent delivery of excellence, instilling confidence through dependable performance. Innovation, meanwhile, reflects TRO-VEST’s commitment to leveraging modern tools and technologies to unlock new value in a dynamic financial landscape.

He further emphasized that the company’s investment philosophy is anchored in a set of principles that work together to ensure long-term value creation. These include crafting comprehensive strategies tailored to each client’s financial realities, maintaining a focus on sustainable returns over fleeting short-term gains, and employing intelligent diversification to manage risk while enhancing potential. TRO-VEST also places a strong emphasis on flexibility, ensuring that strategies adapt to the evolving needs of clients. Through multi-asset investing, the firm captures performance across a broad spectrum of opportunities, while a broader diversification framework allows for protection and growth by engaging both local and global markets.

“At TRO-VEST,” Adekunle concluded, “we don’t just manage money, we build and preserve financial legacies. Every naira entrusted to us is managed with care, integrity, and vision. We’re not chasing trends; we’re building futures.”

In discussing how TRO-VEST aligns its strategies with long-term wealth creation, he stressed that the firm’s belief is that true wealth should be sustainable, diversified, and structured to stand the test of time, ready to be passed on to future generations. According to him, TRO-VEST’s investment approach is designed to reflect this philosophy by combining active risk management, deep market research, asset class diversification, and customized investment horizons tailored to each client’s unique goals.

Rather than focusing solely on short-term gains, TRO-VEST encourages clients to think holistically, aligning their portfolios with life goals such as retirement planning, legacy building, business expansion, or capital preservation. Adekunle explained that the firm doesn’t merely manage assets; it manages outcomes, helping clients cultivate wealth that endures beyond the individual.

“At TRO-VEST, we are building a legacy-focused asset management firm where discipline meets innovation,” he stated. “Every client, regardless of net worth, is given a personalized and strategic roadmap to financial independence and generational impact. True wealth,” he added, “is not what you earn, it’s what you grow. And we are committed to growing it with you.”

Commenting on how the firm has embraced technology to enhance service delivery, Adekunle emphasized that digital innovation lies at the heart of TRO-VEST’s client experience. He noted that technology is not just an enabler, it’s a necessity. “TRO-VEST has deployed a secure, mobile-first investment platform that allows clients to onboard seamlessly, monitor real-time portfolio performance, access account statements, and communicate directly with relationship or wealth managers. Clients can also automate their investment contributions, making the entire process more efficient and user-friendly. From WhatsApp-based communication and account verification to intuitive dashboards, Adekunle explained that the firm continues to innovate in ways that make smart investing simple, accessible, and transparent for every client”.

The TRO-VEST boss highlighted some of the firm’s key investment offerings, noting that TRO-VEST Asset Management Limited provides a future-ready suite of solutions designed to help clients grow, preserve, and transfer wealth across generations. These offerings combine the depth of traditional financial wisdom with the agility of modern innovation. From tailored Portfolio Management for individuals, corporates, and institutions, to bespoke wealth management solutions for high-net-worth clients, TRO-VEST delivers value across diverse investor segments. The firm also offers Financial Investments &Digital Solutions, tech-enabled financial platforms that ensure easy, transparent, and secure investment experiences. For more sophisticated investors, TRO-VEST provides Structured and Alternative Investment Transactions, including private placements. Each product, Adekunle emphasized, is backed by rigorous research, strong compliance standards, and a clear focus on delivering meaningful client outcomes.

He therefore reiterated that to every Nigerian, whether a salary earner, business owner, retiree, or corporate executive that TRO-VEST is ready work the journey with them as they don’t have to figure out wealth creation on their own. In his words, “You don’t have to navigate the path to wealth creation alone. At TRO-VEST, we are committed to walking that journey with you. Through expert guidance, personalized strategies, and a foundation built on transparency and integrity, we aim to help you grow, protect, and multiply your wealth in a manner that is both ethical and sustainable. This is an open invitation to partner with a firm you can trust, an invitation to grow your wealth the right way, with TRO-VEST Asset Management Limited”.

Quote: “TrustArthur is one of the few African Institutions to offer end-to-end Shariah governance, ensuring that every investment adhere to ethical principles”